Now we’ll look at some real-world shipping scenarios derived from ShippingEasy customer data (with all identifying characteristics removed) to examine the kinds of shipping methods used for actual shipments, versus what method would make sense given the rate changes coming in 2016.

- Due to sometimes incomplete customer data (e.g., no weight provided when a seller used USPS Flat Rate or Regional Rate services), we have indicated assumptions and potential options where appropriate

All previously stated assumptions apply, e.g.:

- These are primarily small-and medium-size eCommerce businesses, shipping between 1,000 and 20,000 shipments per month

- We used available 2016 pricing data from each carrier:

- USPS Commercial Plus® Pricing

- FedEx Standard List Rates, including fuel and residential surcharges

- UPS Daily Rates, including fuel and residential surcharges

- Negotiated FedEx or UPS rates may make their services significantly more attractive in some of these scenarios

eCommerce Rate Case Study 1: Beauty & Cosmetics

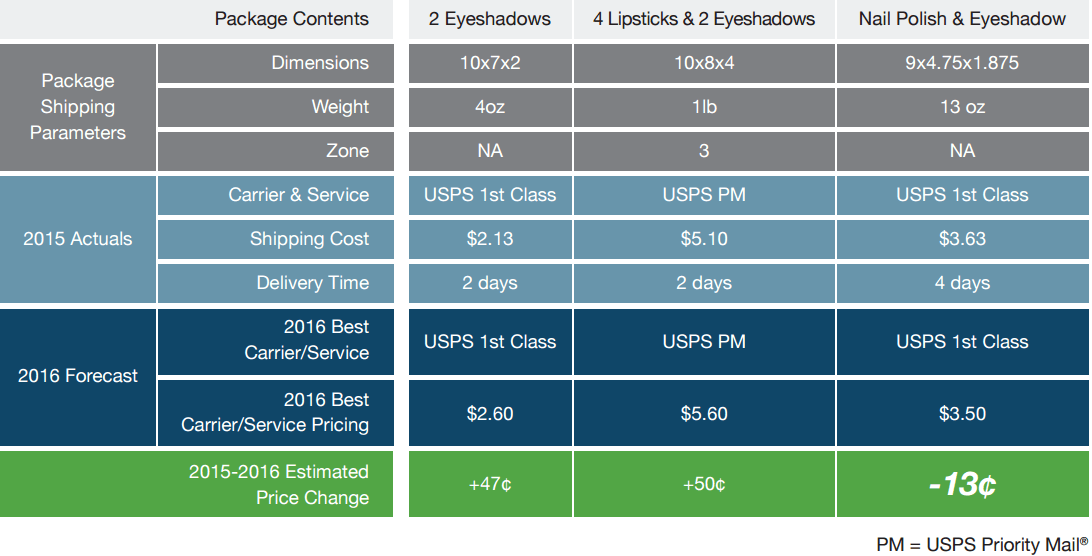

Our first case is derived from a pair of online cosmetics retailers that ship high volumes of primarily small packages. As you can see, USPS was far and away their most cost-effective option in 2015 and, despite price increases, will remain so in 2016.

Beauty & Cosmetics Shipping Mix

When it comes to beauty and cosmetics, you can see that item delivery time isn’t as pressing for them as it would be in other industries. They also provide customers with a flat shipping rate, incentivizing free shipping if an order becomes large enough.

Beauty & Cosmetics shipping changes going into 2016

Moving into 2016, they will not be changing any shipping services for their products, moving most average order prices up, only with a slight decrease in a sample Nail Polish & Eyeshadow order.

eCommerce Rate Case Study 2: Clothing & Apparel

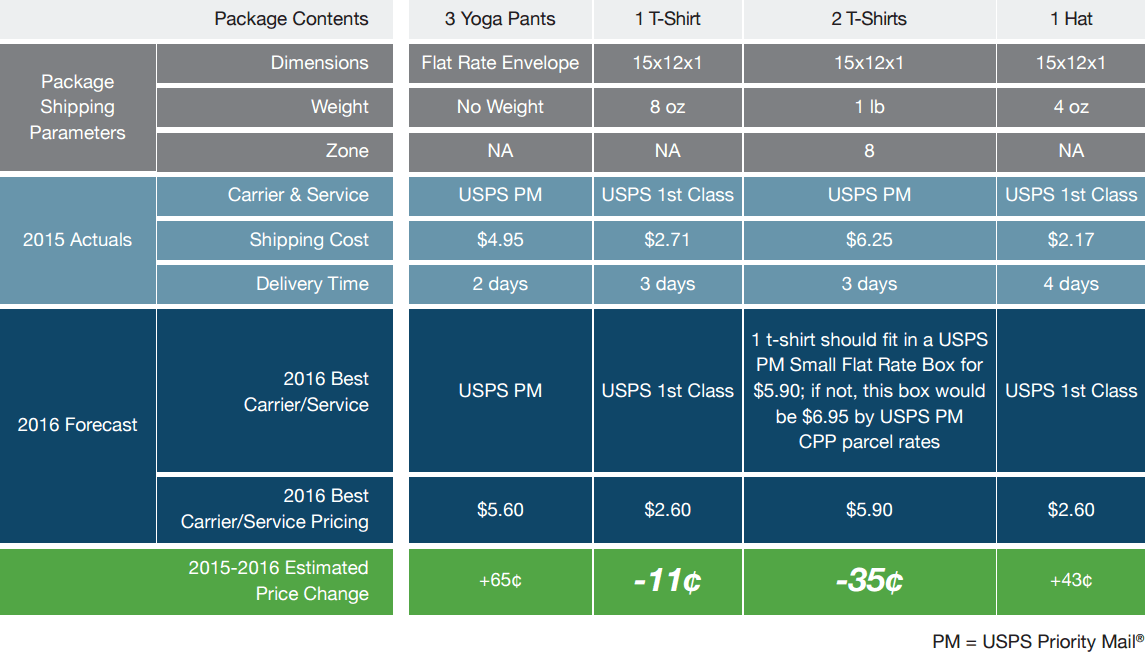

Our second case is derived from a pair of online apparel retailers that ship high volumes of primarily small, soft packages (clothing articles). As with the first Case Study, USPS was far and away their most cost-effective option in 2015 and, despite price increases, will remain so in 2016.

Clothing & Apparel Shipping Mix

Our clothing case study company offered a flat rate to shoppers, with an extra expedited 2-3 day option.

Clothing & Apparel shipping changes going into 2016

By getting smarter with shipping utilizing Flat Rate over opting for Priority Mail every time, our clothing case study company manages to save on shipping out 2 t-shirts, but get a cost increase on orders that need to go out using Priority Mail.

eCommerce Rate Case Study 3: Food & Beverage

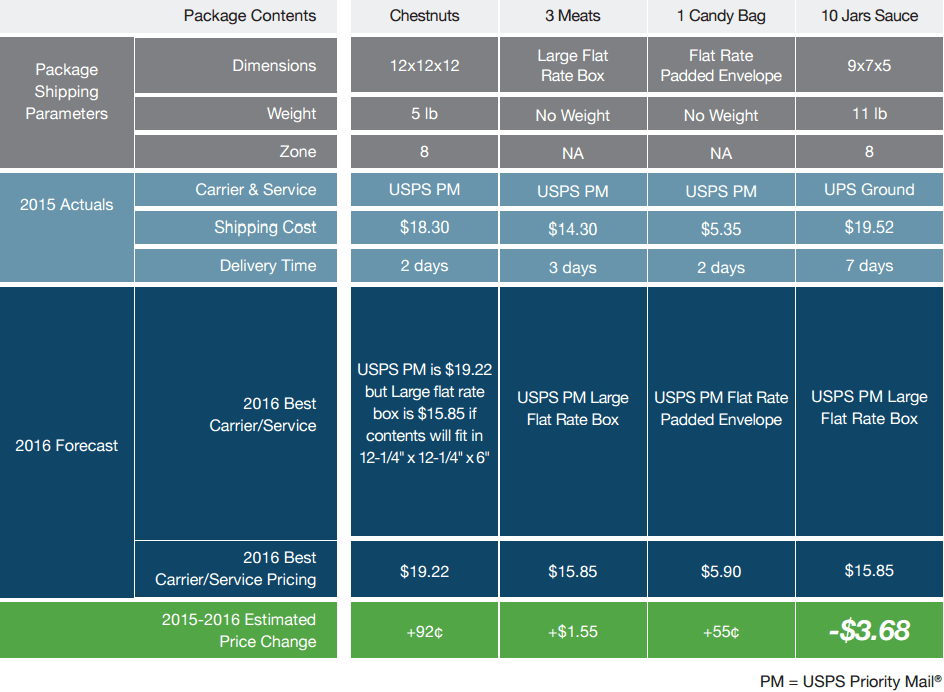

Our third case is derived from a pair of online grocers that ship high volumes of relatively dense packages, often requiring special packaging (for liquids or perishables requiring cold packs). USPS is generally the best option.

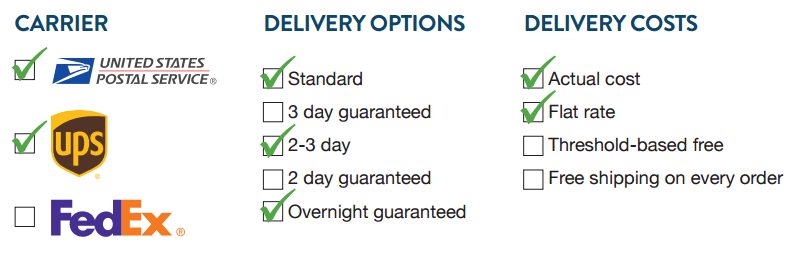

Food & Beverage Shipping Mix

Being a food and beverage company, our business needs to offer more dynamic options to their customers, with the option for overnight shipping on perishable goods. You can see they offer UPS as part of their shipping mix for heavier ground shipping.

Food & Beverage shipping changes going into 2016

Average orders are heavier than your usual eCommerce business with groceries, average orders are going up in price, but our food business will be switching to Flat Rate for the heaviest of orders.

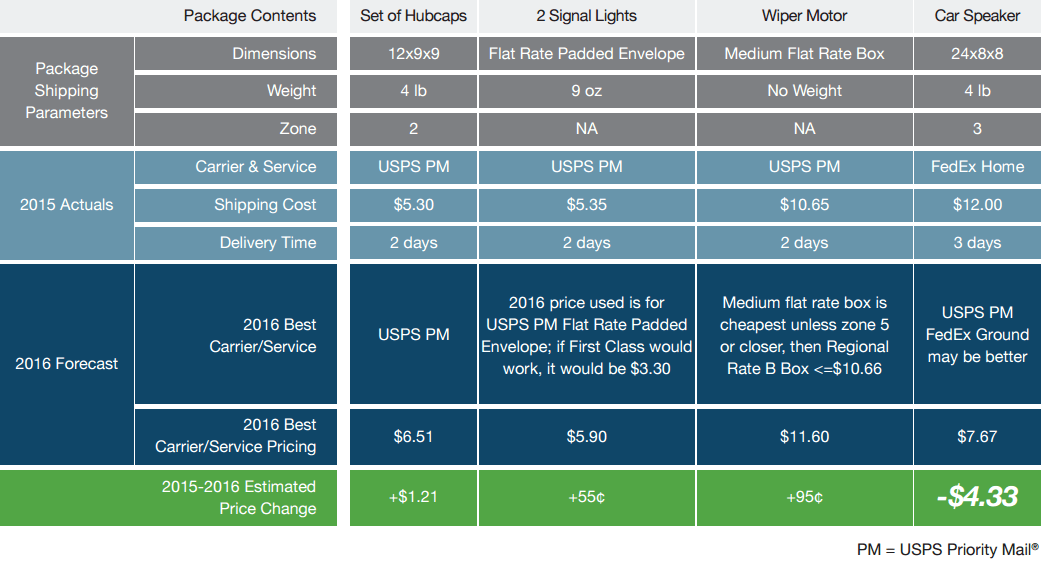

eCommerce Rate Case Study 4: Automotive Parts

Our fourth case is derived from a pair of online automotive retailers that ship high volumes of relatively large, sometimes dense, often bulky packages. This case illustrates that when we get into heavier packages FedEx can sometimes beat USPS, even assuming USPS CPP and FedEx Standard rates. Retailers dealing in larger/heavier packages with decent volumes and no delivery timing commitment requirements should definitely explore potential negotiated rates with UPS and FedEx. Also, as noted, they may have some significant opportunities to reduce costs by optimizing their packaging to allow use of Flat Rate or Regional Rate containers.

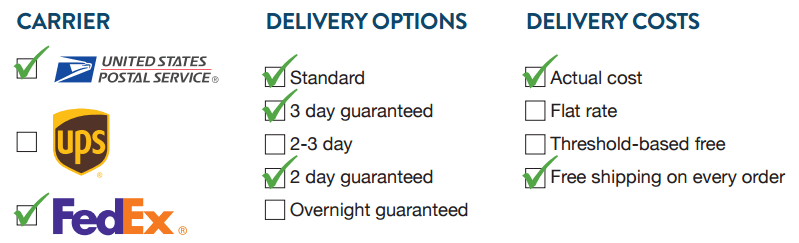

Automotive Parts eCommerce Shipping Mix

Automotive parts come in all shapes, sizes, prices, and work with mechanics and other business, hence the need for dynamic and guaranteed shipping options. To handle less urgent customer demands, they offer standard shipping free to customers as an option.

Automotive Parts shipping changes going into 2016

As you can see Priority Mail rates are leading to an increase in shipping, but some savings can be had moving over from FedEx Home over to Priority Mail as well when you add in the surcharges applied by FedEx. One piece of information unknown is what rates our seller has negotiated with their FedEx rep, as rates are likely lower on FedEx Home shipments if negotiations have been made.

Conclusion

As you can see, if our sellers were previously using Priority Mail to ship orders, they will be having a slight increase to average order shipping cost. A lot, however, can see savings by moving off of private carriers and moving to Flat Rate or Priority Mail when new private carrier surcharge and rate increases are a factor. It’s likely if a seller is high volume, they will have the ability to negotiate better rates from their account rep, but that can be seen as a negative aspect to private carriers are the lowest rates possible from USPS do not require negotiations if you ship with a software solution like ShippingEasy.

This is from the eCommerce Seller’s Guide to 2016 Shipping Rate Changes by ShippingEasy:

Request a Demo