Here at ShippingEasy, we know tax season is a pain for most online sellers. We don’t claim to be experts in collecting and filing taxes, but luckily, we know many people who are! As such, we’ve put together some last-minute resources to help you with your 2018 e-commerce taxes so you don’t have to scour the internet for the answers you need.

Deadline for filing your 2018 e-commerce taxes: April 17, 2018

Circle it on the calendar, I’ll wait….ok. Now, let’s get into some high-level overviews of some things you should know as you prepare your 2018 e-commerce taxes.

Everyone’s favorite part: tax write-offs

Hopefully, you’ve been keeping track of your receipts and expenditures throughout the year, either in a filing cabinet, scanning them to a folder, tracking them with software, or at minimum putting them in the classic shoe box. Below is a summary of some deductible expenditures, though it’s certainly not an exhaustive list.

- Receipts from items purchased specifically for your business

- Physical items like computer hardware, office supplies, scales, scanners, etc

- Software like accounting software, Microsoft Office, etc

- Shipping costs and materials

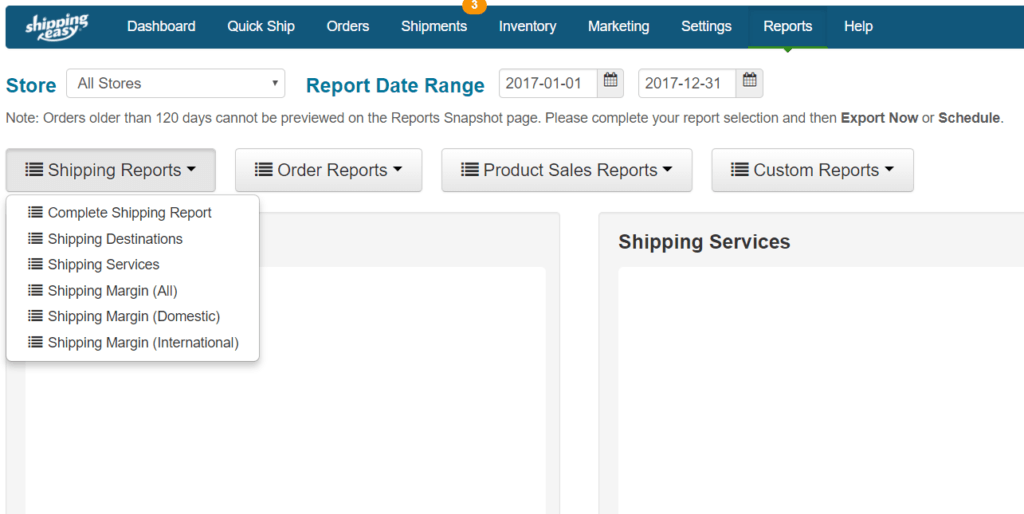

- Your shipping software should allow you to access reports of how much you paid in USPS shipping costs throughout the year

- Here’s how to access them if you’re a ShippingEasy customer

- FedEx, UPS, and consolidator shipping charges can be accessed through your personal profiles on those websites

- Packing materials, boxes (though you can get free materials for many shipping options), labels, etc

- Independent contractors and employees (salary and benefits)

- Home business? Deduct your office space using either the simplified or regular method of calculating

- Marketing and advertising costs

- For example, if you use something like ShippingEasy’s Customer Marketing platform to send email communications to customers, you can deduct the cost

- Social tools like Hootsuite or Buffer also count

- Any continuing education, conferences, or paid meet-ups can be written off

- Business travel to trade shows, to meet customers, etc

You can find more possible e-commerce deductions in this article from our friends at Shopify.

Keeping accurate records will save you money, make your taxes a bit easier, and cut a ton of your time investment during this time of year.

Forms, forms, forms

Tax season brings with it a plethora of forms to keep track of. It’s impossible for us to include every single one here, but we can point out a few important ones you should make sure you’re obtaining.

Schedule C

The IRS describes the Schedule C form as follows:

- Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

Anyone who is self-employed or can be listed as a sole-proprietorship needs to complete this form when filing taxes.

1099-K

The 1099-K includes things like sales tax and shipping fees. Individual online sellers are not responsible for filling out a 1099-K. If you sell on Amazon, Etsy, eBay, Bonanza, etc, the form should be filled out by that marketplace and sent to you, as they are also required to provide the 1099-K to both the IRS and sellers if they meet certain criteria. This should have been sent to you before January 31.

The IRS explanation of this form is:

- Form 1099-K, Payment Card and Third Party Network Transactions, is an IRS information return used to report certain payment transactions to improve voluntary tax compliance. You should receive Form 1099-K by January 31st if, in the prior calendar year, you received payments:

- from payment card transactions (e.g., debit, credit or stored-value cards), and/or

in settlement of third-party payment network transactions above the minimum reporting thresholds of –

gross payments that exceed $20,000, AND - more than 200 such transactions

- from payment card transactions (e.g., debit, credit or stored-value cards), and/or

If you haven’t hit the above thresholds, but still had more than 50 transactions in the past year, you’re still required to provide tax information to the government.

The Sales Tax Conundrum

While the Supreme Court is still figuring out how to handle online sales tax across the board, the burden falls on sellers to report sales tax by each state your business has an established presence in. This presence is called the Sales Tax Nexus. Ominous sounding, we know, and the definition is somewhat vague.

Generally, if you have an employee, an office, a warehouse, or some other physical presence in a state, you are expected to collect sales tax for items sold to customers in those states, and report it. The frequency also varies (monthly, quarterly or annually). Fun, right? Luckily, there are software solutions out there that help you track and report this.

Another hitch in the sales tax conundrum is returns. When you give refunds, you also refund the sales tax. Since sales tax changes from year to year, you’ll need to make sure that you report any amendments to your sales tax collections for the year of the original sale, not the time of refund. This way, states make sure everything matches. This can be a pain given that the highest volume of returns come right at post-holidays and a new year.

As with sales tax collection, this also varies state by state. Luckily, the folks over at TaxJar put together a solid article collecting everything you need to know about sales tax reporting. They also partnered with BigCommerce to break down every state and their Nexus requirements.

Every marketplace has its quirks

If you’re a multichannel seller, things can get a little more complicated. Though there are similarities in many of them, such as receiving a 1099-K and reporting with a Schedule C form, there are also slight variances. We’ve pulled together a few specifics on some of the marketplaces with unique scenarios.

- 2018 e-commerce taxes: Etsy sellers

- 2018 e-commerce taxes: eBay sellers

- 2018 e-commerce taxes: Amazon sellers

Filing your e-commerce taxes is never quite going to be easy, but with the right planning, the right organization, and an evening locked away in a room, you can accurately knock out this task for another year. Good luck!

We don’t just make accessing your reports easy, we make everything easy. Hit the button below and give us a spin, FREE for 30 days!

Rob Zaleski

Latest posts by Rob Zaleski (see all)

- USPS 2023 Shipping Rate Changes - November 16, 2023