Carriers

Every carrier offers its own supplemental insurance, which you can purchase directly when setting up your shipment.

Third Parties

There are numerous third-party insurance providers such as Shipsurance, ShippingEasy’s insurance partner. You purchase insurance from these companies on a shipment-by-shipment basis.

ShippingEasy’s partnership with Shipsurance means it’s easy to automatically or manually add supplemental insurance as part of the shipping label generation process; see http://bit.ly/Insurepackages for more information on manually adding insurance, and see http://bit.ly/InsuranceDefaults for more information on setting up automatic insurance defaults.

ShippingEasy also lets you set up powerful if/then rules that can be used to further automate the inclusion of supplemental insurance; see http://bit.ly/ShippingRules for more information.

Self-insurance

Theoretically, shippers who “self-insure” save money over other options by factoring the cost of losses into their pricing then carefully managing the claims process. In reality, few eCommerce sellers are sophisticated or large enough to do this efficiently and effectively, and when they try they end up spending more on loss coverage than they would under any of the other options.

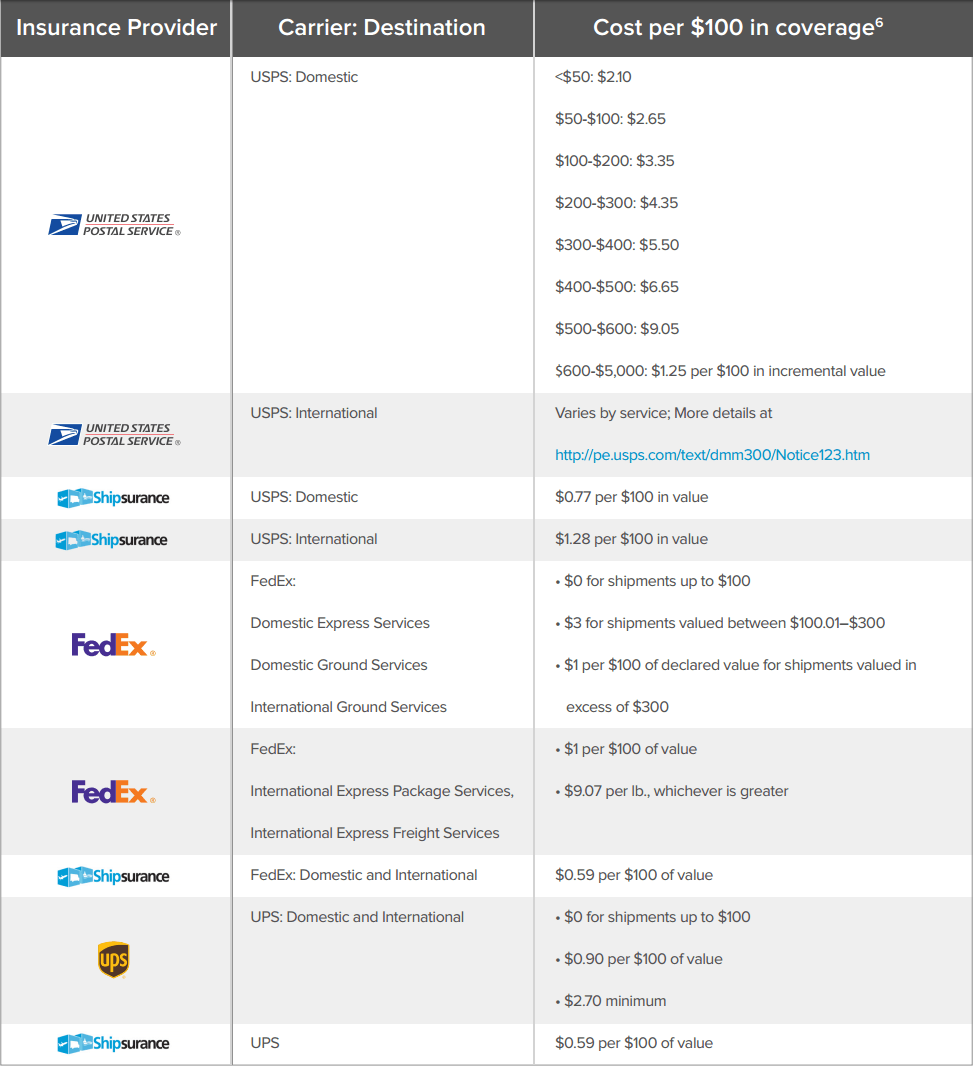

Since carrier pricing is public, we can compare the major carriers’ supplemental insurance costs with those of Shipsurance’s ShippingEasy program costs:

Depending on your volume and other factors, you may be able to negotiate better shipping rates with your carrier(s) and/or a third-party provider. Check with your rep if you think this may be an option for you.

Request a Demo