For items that are insurable, the decision to insure is based on two basic attributes: each item’s value and the risk of it being lost, damaged or stolen during shipping. While these attributes seem simple, they contain a number of criteria you should analyze to get the most value out of shipping insurance for both your company and your customers.

Types of Insurance Shipment Values

Obviously, the higher the value of an item, the higher the incentive to insure it. However, there are still a number of value-related criteria to consider:

- Declared value: Most carriers and insurers focus on an eCommerce shipper’s declared value—what you say it’s worth. If something goes wrong with the shipment and you have to file a claim, you will need to prove the item’s value, and the insurer will pay you that value or the declared amount, whichever is smaller. This means if you sell high-value, high-margin items, you can provide some level of protection by declaring the item’s replacement cost to you, the seller, rather than the marked-up retail replacement cost. For more information on how FedEx defines declared value, refer to http://bit.ly/FedExValue for more information on the UPS definition, refer to http://bit.ly/UPSValue.

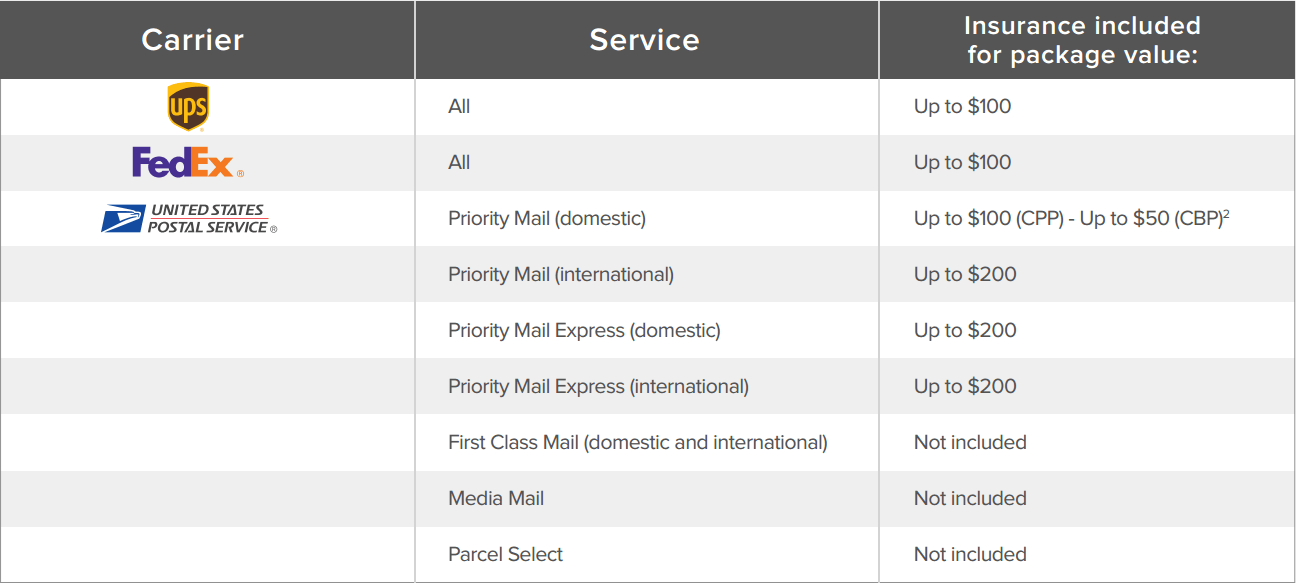

- Items covered by included insurance: All major carriers provide free coverage up to a certain amount, as outlined in the following table. Keep in mind that these limits apply to the entire package, so if you are shipping multiple items in one package that add up to a higher value than the stated limit, you’ll need to purchase supplemental insurance if you want them to be fully covered.

Included Insurance by Shipping Carrier

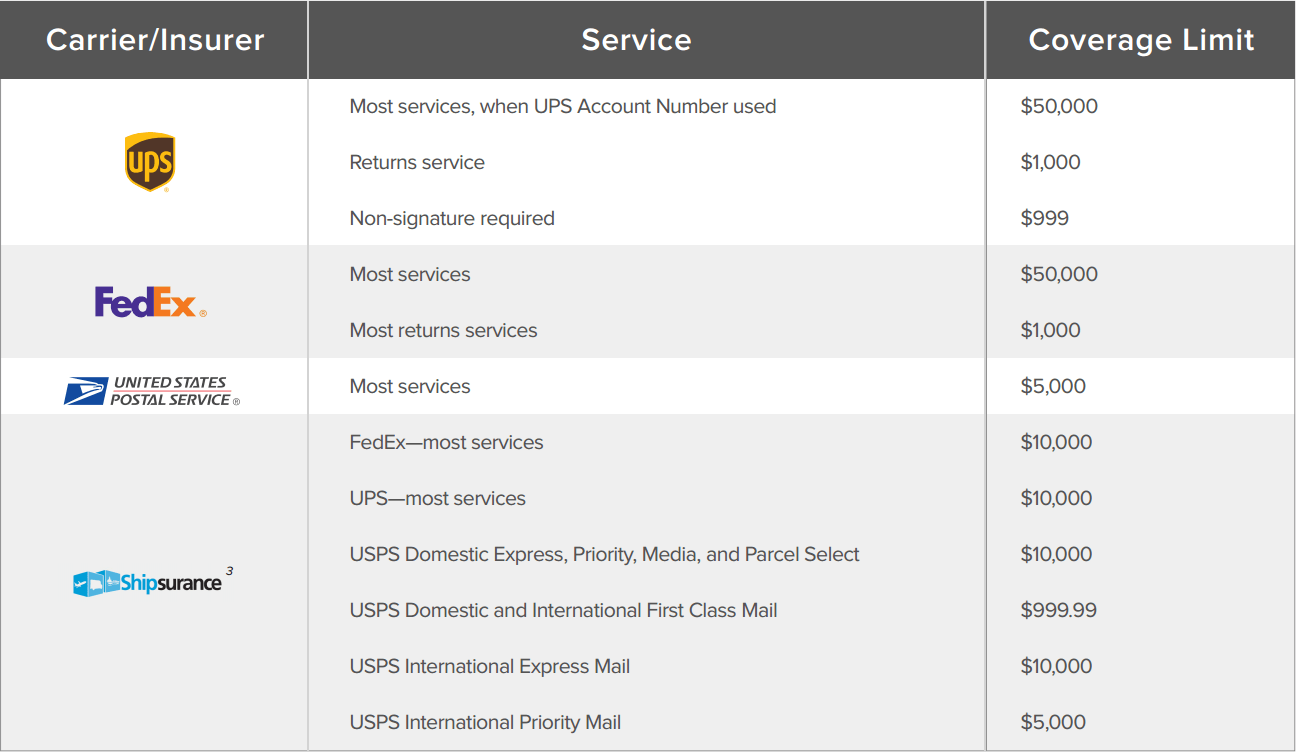

- High-value items: All carriers (and third-party insurers) have limits on declared value, both absolute and by item type

For some current examples see the following table, but before making any concrete decisions, be sure to check with your carrier on the details. Carrier/Insurer Service Coverage Limit

Shipping Insurance Limits

It’s important to note here that for many carriers, the declared value amount can apply to the value of the package contents only—in the event of a claim, the costs of packaging and shipping will not be covered. Some third-party providers (like Shipsurance, ShippingEasy’s insurance partner) will cover packaging and shipping if these costs are included in the declared value and invoiced to the customer

For more information on coverage limits, refer to http://bit.ly/InsuranceLimits.

Next: Shipping Insurance: Ways Your Shipment Can Be Lost

This article is an excerpt from The eCommerce Seller’s Guide to Shipping Insurance

Request a Demo